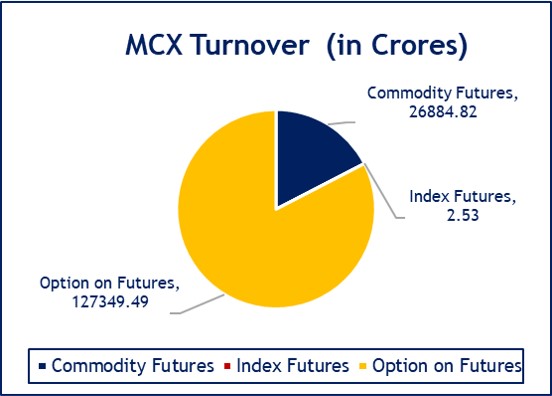

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.154236.84 crores in various futures & option contracts for commodities listed at MCX on Wednesday, April 09, 2025 till 5:00 pm. In which commodity futures accounted for Rs. 26884.82 crores and options on commodity futures for Rs. 127349.49 crores (notional). Bullion Index MCXBULLDEX Apr-25 futures was reached at 20666.

Commodity Future Contracts:

Commodity Future Contracts:

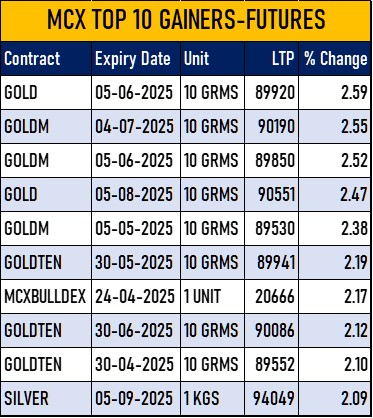

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 20367.47 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was up by Rs.2272 or 2.59% to Rs. 89920 per 10 gram, GOLDTEN April-2025 contract was up by Rs.1846 or 2.1% to Rs. 89552 per 10 gram, GOLDGUINEA April-2025 contract was up by Rs.1235 or 1.75% to Rs. 71867 per 8 gram and GOLDPETAL April-2025 contract was up by Rs.147 or 1.65% to Rs. 9033 per gram. On other hand, GOLDM May-2025 contract was up by Rs.2081 or 2.38% to Rs. 89530 per 10 gram.

SILVER futures, with May-2025 expiry contract was up by Rs.1742 or 1.96% to Rs. 90486 per kg, while SILVERM April-2025 contract was up by Rs.1680 or 1.89% to Rs. 90553 per kg and SILVERMIC April-2025 contract was up by Rs.1697 or 1.91% to Rs. 90555 per kg.

GOLD futures clocked turnover of Rs. 9888.52 crores with volume of 11087 lots and OI of 19290 lots while SILVER futures clocked turnover of Rs. 3916.42 crores with volume of 14486 lots and OI of 27554 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 2565.52 crores. COPPER April-2025 contract was up by Rs.3.9 or 0.49% to Rs. 801.75 per kg and ZINC April-2025 contract was down by Rs.0.65 or 0.26% to Rs. 245.6 per kg while ALUMINIUM April-2025 contract was down by Rs.1.2 or 0.52% to Rs. 230.1 per kg and LEAD April-2025 contract was up by Rs.0.25 or 0.14% to Rs. 175.6 per kg.

COPPER futures clocked turnover of Rs. 1646.58 crores, ALUMINIUM futures Rs. 143.48 crores, LEAD futures Rs. 107.41 crores, and ZINC futures clocked turnover of Rs. 469.63 crores.

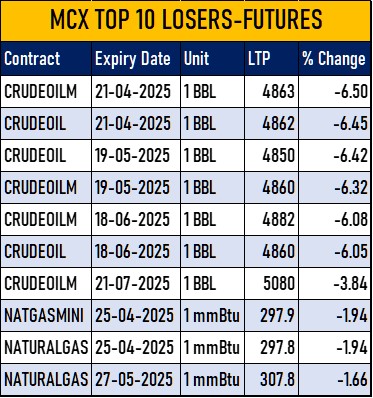

Energy: Turnover of energy futures products contributed for Rs. 4058.10 crores. CRUDEOIL April-2025 contract was down by Rs.335 or 6.45% to Rs. 4862 per BBL while NATURALGAS April-2025 contract was down by Rs.5.9 or 1.94% to Rs. 297.8 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 2129.86 crores and NATURAL GAS futures Rs. 1430.45 crores.

AGRI: MENTHAOIL April-2025 contract was up by Rs.2.5 or 0.27% to Rs. 915 per kg .

Options on Commodity Future Contracts:

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 127349.49 crores turnover (notional), having premium turnover of Rs. 3000.95 crores.

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option April-2025 contract at Strike price of Rs.5000 was down by Rs.143.5 or 46.07% to Rs. 168.00 with volume of 97539 lots & OI of 9274 lots, while CRUDE OIL Put Option April-2025 contract at Strike price of Rs.5000 was up by Rs.191.9 or 172.42% to Rs. 303.2 with volume of 118806 lots & OI of 5636 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option April-2025 contract at Strike price of Rs.300 was down by Rs.2.4 or 12.66% to Rs. 16.55 with volume of 22304 lots & OI of 4388 lots, while NATURAL GAS Put Option April-2025 contract at Strike price of Rs.300 was up by Rs.2.85 or 18.39% to Rs. 18.35 with volume of 24072 lots & OI of 5761 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option April-2025 contract at Strike price of Rs.90000 was up by Rs.1049 or 183.07% to Rs. 1622 with volume of 2124 lots & OI of 574 lots, while GOLD Put Option April-2025 contract at Strike price of Rs.88000 was down by Rs.652 or 40.83% to Rs. 945 with volume of 2775 lots & OI of 831 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option April-2025 contract at Strike price of Rs.90000 was up by Rs.1049 or 183.07% to Rs. 1622 with volume of 2124 lots & OI of 574 lots, while GOLD Put Option April-2025 contract at Strike price of Rs.88000 was down by Rs.652 or 40.83% to Rs. 945 with volume of 2775 lots & OI of 831 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option April-2025 contract at Strike price of Rs.90000 was up by Rs.1001.5 or 54.4% to Rs. 2842.5 with volume of 2135 lots & OI of 427 lots, while SILVER Put Option April-2025 contract at Strike price of Rs.89000 was down by Rs.773.5 or 30.26% to Rs. 1783 with volume of 1393 lots & OI of 344 lots.

Commodity Future Contracts:

Commodity Future Contracts:

Options on Commodity Future Contracts:

Options on Commodity Future Contracts:  GOLD Options: Most traded contracts among GOLD Options were Call Option April-2025 contract at Strike price of Rs.90000 was up by Rs.1049 or 183.07% to Rs. 1622 with volume of 2124 lots & OI of 574 lots, while GOLD Put Option April-2025 contract at Strike price of Rs.88000 was down by Rs.652 or 40.83% to Rs. 945 with volume of 2775 lots & OI of 831 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option April-2025 contract at Strike price of Rs.90000 was up by Rs.1049 or 183.07% to Rs. 1622 with volume of 2124 lots & OI of 574 lots, while GOLD Put Option April-2025 contract at Strike price of Rs.88000 was down by Rs.652 or 40.83% to Rs. 945 with volume of 2775 lots & OI of 831 lots.